Emily, 34 – Remote Worker in Colorado

“I needed a plan that covered me in both Colorado and California. The PPO I found through this site saved me over $300/month and gave me access to my preferred OB-GYN out of state.”

Whether you’re looking for the best PPO insurance plans or need flexible PPO coverage without referrals, our platform helps you compare options designed for individuals just like you.

Compare PPO plans designed for your lifestyle—whether you’re self-employed, managing a family, or working across state lines. Click below to explore options by need:

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers maximum flexibility. You can visit any doctor or specialist without needing a referral, including out-of-network providers, though in-network visits cost less. PPOs are ideal for individuals who value provider choice, frequently travel, or live in areas with limited in-network options.

Need coverage where you live? Check out these localized PPO plan options in some of the most popular states we serve:

We’ve helped thousands of individuals across the U.S. enroll in high-quality PPO plans since 2009. Our licensed agents work with trusted national carriers including UnitedHealthcare, Blue Cross Blue Shield, Aetna, and Cigna. Every plan we quote meets ACA compliance standards and includes the 10 essential health benefits required under federal law.

As an independent brokerage, we provide unbiased guidance based on your needs, not commissions. We’re A+ rated by the Better Business Bureau and committed to simplifying your coverage selection without upselling or pressure.

PPO plans are especially well-suited for:

| Criteria | PPO Plans | HMO Plans |

|---|---|---|

| Provider Flexibility | High – choose any provider, in or out of network | Low – must stay within network |

| Referrals Required | No – direct access to specialists | Yes – need referral from primary care provider |

| Out-of-Network Coverage | Yes – covered at a higher cost | Only in emergencies |

| Monthly Premiums | Typically higher | Typically lower |

| Best For | Travelers, self-employed, multi-state access | Cost-conscious individuals, local care needs |

Because most national PPO plans are sold off the exchange, they often have standard pricing that doesn’t vary by age, especially between ages 18 to 64. You’ll find plans that offer nationwide coverage, low deductibles, or broad networks with monthly premiums that reflect these benefits. In contrast, on-exchange PPOs vary by state and are typically priced by age and tobacco use. When comparing PPO costs, focus on:

While PPOs provide maximum flexibility, you may come across other plan types like EPO (Exclusive Provider Organization) or POS (Point of Service). Understanding these differences helps ensure you select the right coverage for your lifestyle:

Learn more about PPO plans tailored for the self-employed to explore your options.

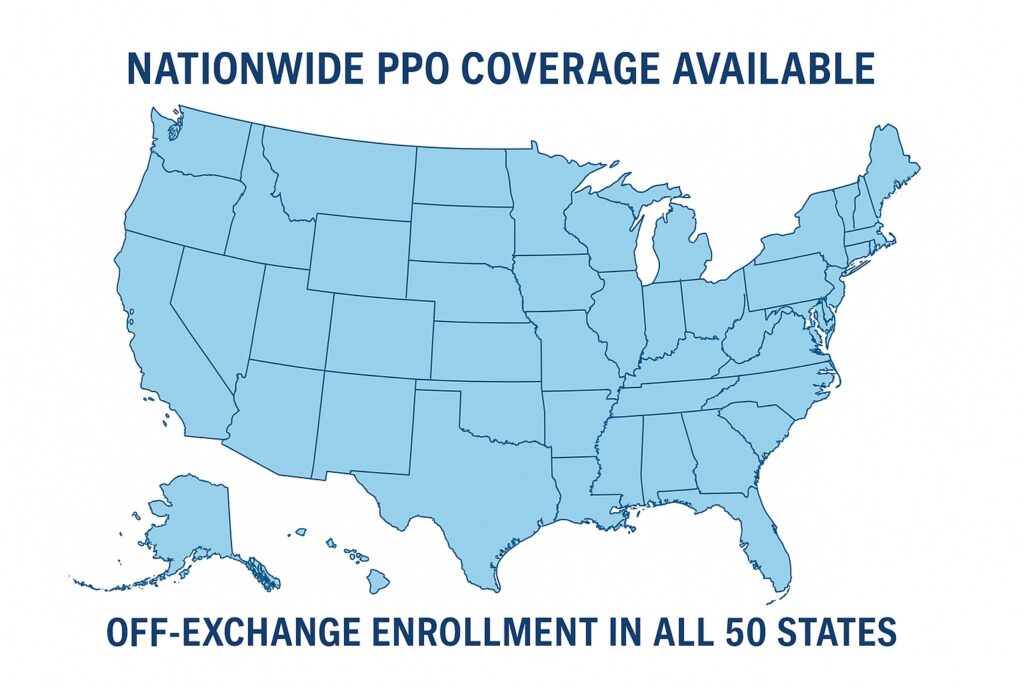

PPO networks are made up of doctors, hospitals, labs, and pharmacies that have negotiated discounted rates with the insurer. Unlike HMOs, which limit you to a smaller list of local providers, PPOs often contract with thousands of providers nationwide. This means you can receive care across state lines without needing a new plan, making PPOs ideal for frequent travelers and remote professionals.

While PPOs offer unmatched flexibility, it’s important to understand the fine print. Out-of-network services may be covered, but often at a lower rate, meaning higher out-of-pocket costs. Additionally, balance billing (where a provider charges you the difference between their rate and what your insurer pays) is possible. Always check for:

While PPO plans offer strong benefits, they’re not the right choice for everyone. If you:

Then, an HMO or EPO may be a better fit. Our licensed agents can help you weigh all your options and find a plan that matches your lifestyle and budget.

“I needed a plan that covered me in both Colorado and California. The PPO I found through this site saved me over $300/month and gave me access to my preferred OB-GYN out of state.”

“HMOs were too restrictive for my needs. With a PPO, I see my chiropractor without referrals and use providers in multiple counties. Totally worth the upgrade.”

Yes. Many national and regional insurers offer PPO plans directly to individuals.

PPO plans let you choose providers freely, including out-of-network. HMOs require referrals and limit networks.

Generally yes, but they offer greater flexibility and access to a wider range of providers.

No. You can see specialists directly.

Yes, though availability and pricing vary by state and county.

Not all health plans are created equal. When you compare PPO quotes through our platform, you’re gaining access to flexible coverage options that prioritize choice, convenience, and nationwide provider access. For those tired of HMO restrictions or seeking care across multiple states, PPOs are often the best option available off the exchange.

Need help choosing a PPO plan? Call (888) 215-4045 to speak with a licensed agent, or get your free quote now.

Prefer to speak with an agent?