Shop Affordable Pennsylvania PPO Plans in all 67 Counties

At Vista, we understand the importance of finding the best Pennsylvania PPO health insurance plan for you. Our team is dedicated to providing you with all the information you need to make an informed decision when shopping for Pennsylvania PPO plans. We’ll help you find the best plan for your needs, and compare Pennsylvania PPO rates so that you can get the most value for your money.

At Vista, we understand the importance of finding the best Pennsylvania PPO health insurance plan for you. Our team is dedicated to providing you with all the information you need to make an informed decision when shopping for Pennsylvania PPO plans. We’ll help you find the best plan for your needs, and compare Pennsylvania PPO rates so that you can get the most value for your money.

Pennsylvania PPO Rates for 2025

The figure below is a table of Individual Pennsylvania PPO plan options. The information included, such as Rates and benefits are approximated. Please call for specific plan information.

| Plan Name | Cigna PPO Low Plan | Cigna PPO Flex Plan | Cigna PPO High Plan | Cigna PPO Premium Plan |

|---|---|---|---|---|

| PCP Copay | $25 (6 visits limit) | $30 | $30 | $20 |

| Specialist Copay | $50 (6 visits limit) | $60 | $60 | $40 |

| Deductible | $0 | $6,000 | $3,000 | $1,000 |

| Rx: Generic/Brand/High Brand | $10 / NA / NA | $15 / $65 / $100 | $15 / $65 / $100 | $15 /$45 / $85 |

| Premium (single) | $510.00 | $854.50 | $958.00 | $1242.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 (6 visits limit) |

| Specialist Co-pay | $50 (6 visits limit) |

| Rx: Generic/Brand/High Brand | $10 / NA / NA |

| Emergency Room | $350 |

| Hospital Co-pay | $350 |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $0 |

| Max Out of Pocket (single/family) | $7,350 / $14,700 |

| In-Network Co-Insurance | N/A |

| Out-of-Network Benefits | ---------- |

| Deductible | N/A |

| Out of Pocket Max (single/family) | N/A |

| Co-Insurance | N/A |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $25 |

| Renewal Date | 20th of month Prior to Effective date |

| Premium | ---------- |

| Single | $510.00 |

| Couple | $817.00 |

| E+child | $736.25 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $6,000 / $12,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $12,000 / $24,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | --------------------- |

| Single | $854.50 |

| Couple | $1,492.00 |

| E+child | $1,345.50 |

| Family | $1,909.50 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $3,000 / $6,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,000 / $12,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $958.00 |

| Couple | $1,684.00 |

| E+child | $1,516.00 |

| Family | $2,164.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $15/$45/$85 |

| Emergency Room | 20% after deductible |

| Hospital Co-pay | 20% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $1,000 / $2,000 |

| Max Out of Pocket (single/family) | $5,000 / $10,000 |

| In-Network Co-Insurance | 20% |

| Out-of-Network Benefits | ---------- |

| Deductible | $2,000 / $4,000 |

| Out of Pocket Max (single/family) | $10,000 / $20,000 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $20 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $1242.00 |

| Couple | $2,257.00 |

| E+child | $2,018.00 |

| Family | $2,942.00 |

Pennsylvania PPO Insurance Carriers

In 2025, Pennsylvania PPO health insurance plans will be exclusively accessible to Small Businesses. Listed below are the carriers that currently offer Pennsylvania PPO health insurance plans. If you are an individual, freelancer, or self-employed individual, kindly contact us to discover the most recent individual carrier PPO plans.

- Aetna

- Ambetter Health

- AmeriHealth

- Capital Blue Cross

- Cigna

- Independence Blue Cross

- Highmark

- Oscar Health Plan

- United Healthcare of Pennsylvania

What to Consider When Shopping for a Pennsylvania PPO Insurance Plan

We have compiled some of the more common concerns when shopping for a Pennsylvania PPO health insurance plan.

Are Your Doctors In-Network? – Before signing any health insurance contract, always make find out if your doctor(s) are part of the network even though a PA PPO plan will cover you for any out-of-network services. Always remember that when you visit an out-of-network doctor, the cost may be substantially higher than if that doctor was in-network.

Always confirm that your Carrier and doctor are in-network with the insurance company before purchasing a health plan. Don’t assume anything from a receptionist—speak directly to the office manager and confirm if your doctor is in the same health network as your carrier.

Why the concern? If your out-of-network physician suggests additional services, then all of those services will probably be considered to be out-of-network even if the hospital or facility where they are performed is in your insurance company’s list of providers. With a PA PPO health plan, any of your out-of-network medical treatments will count towards your out-of-network deductible and coinsurance.

Lower Monthly Premium May Result in Higher Costs – Choosing a plan with a lower monthly premium usually means you will most likely pay higher costs when using your health care. If you are healthy and do not foresee any future health-related issues or have few prescriptions—and thus would spend little in out-of-pocket expenses even under the best-case scenarios, then you are better off choosing a less expensive non-PPO plan.

If you do find that your medical and monthly prescription usage is high, then it may be more costly in the long run to purchase a plan with a higher monthly premium. Be sure to make a fair assessment of your current health when shopping for a Pennsylvania PPO health insurance plan.

Health Insurance is a Contract – The insured agreed to live up to their end of the contract (usually a year). If you find that mid-year, you’re not happy with your plan, you most likely can’t go back to your insurance company and ask to change coverage. Do the research and choose the right plan that suits your needs before signing the contract. If you had insurance through a State Marketplace and it has lapsed, you’re then able to get a PA PPO health plan mid-year, as long as you are employed.

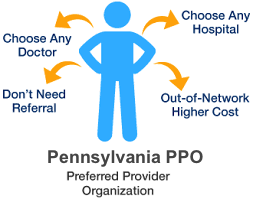

Types of Insurance Coverage – EPO, HMO, PPO, POS, HDHP, and HSA describe different types of health coverage, that provide you with or without the need for referrals to see specialists and receive out-of-network and out-of-state coverage. Additionally, different plans also differ in requirements relative to the need for referrals. If you are receiving care and often see specialists out-of-network then you most likely would want a plan that offers that flexibility(such as PPO).

Those of us who travel often for work or those living in multiple states per year may want to consider a Pennsylvania PPO plan, it offers that flexibility that is needed. The last two types, HDHP and HSA’s allow you to set up a tax-free savings account specifically for qualified medical costs For a better understanding of these types of coverage please refer to the following article.

Are Essential Health Benefits Covered? – All Pennsylvania PPO plans offer coverage for 10 essential health benefits, as required by the Affordable Care Act. This assures you of a certain level of coverage. Why would we need a minimum standard level? Well, medical care can be expensive, so without insurance in place, one may find oneself facing financial ruin. But a plan that includes the minimum essential health benefits (MEHBs) will provide a safeguard against this possibility.

Common Questions with Regard to Pennsylvania PPO Health Plans

Common Questions with Regard to Pennsylvania PPO Health Plans

How much does a Pennsylvania PPO cost?

Because of the extra flexibility that a PPO provides, Pennsylvania’s Health plans are more expensive than other types of health insurance. Use the table above to see PA PPO rates and shop plans in your state.

Does my doctor accept Pennsylvania PPO Insurance?

Using the carrier list above, locate and select your company. Once you’re on their website, Look for your doctor on their PPO network providers list. Additionally, you can always contact your doctor’s office, however, it is best to verify with the health insurance company.

Where can I buy a Pennsylvania PPO health insurance plan?

Local and web broker representatives are the main ways to purchase a PA PPO Health plan. They will also set the health plan up and help you with any premium or claims-related issues that you may have during the plan year. It’s always a better option to work with a broker rep that is appointed with all carriers in your region, giving you a better selection to choose a carrier and plan.

How do I qualify for a PA PPO plan?

you need to be employed, self-employed, or a freelancer.

Can I buy a PA PPO plan anytime?

Yes. Pennsylvania A PPO health insurance plans go into effect at the beginning of any month during the year. You need to finish the application process by the 15th of the month for your plan to start 1st day of the following month.

I’m not happy with my PA PPO health plan, can I switch to a different plan?

A PPO is a contract, that under most conditions cannot be changed until your PPO plan is up for renewal, usually one year after the start date and often on January 1st. You can change from one PA PPO company mid-year to another company, however, are no plans within the same company.

What makes a PPO plan special?

PPO health plans are flexible, that’s what makes them stand out. You can avail healthcare services from any provider, even out-of-network. This feature puts PPO plans above other plan types, such as HMO plans, where you must use their in-network providers. This is especially valuable to those who travel for work regularly.

Is it mandatory to be part of a group or self-employed to buy a PA PPO plan?

There are two common ways of getting a PA PPO health plan:

-As an employee whose company has a PPO plan option.

-By joining a business association that is offering a PPO Plan option(must be a freelancer or a sole proprietor).

Can I buy PPO Health Plans from the PA State Exchange?

Not for Individual health plans. EPOs and HMO plans are the most common options offered through the Federal Exchange and State Exchanges. For a small business, yes, though the PPO plan selection is limited.

Do freelancers qualify for PA PPO plans?

Since the creation of the Affordable Care Act, freelancers, and sole props are considered individuals which means they would need to join a business association that offers Pennsylvania PPO health plans, to purchase an eligible PA PPO plan.

Can seniors 65 and older qualify for a PPO plan?

If that senior is an Employee of a company that has a PPO option then yes they can opt to keep their plan instead of going on Medicare. For someone not working, they would not be eligible for a Pennsylvania PPO plan.

Are PA PPO plans offered as short-term medical plans?

Yes, there are short-term PPO Plans available however almost all short-term medical plans are not comprehensive health insurance plans. Buyer beware, be sure to review the summary of benefits.

Why are PPO plans more expensive than other types of health plans like HMOs?

Their flexibility and higher reimbursement rates paid to select doctors and hospitals are key components of their cost. They are almost always more expensive than a standard HMO where someone must stay within the network and utilize the contracted providers. Remember that you buying into a plan that provides you with national coverage.

Why are there more doctors and hospitals in typical PPO plans than in non-PPO plans?

The reimbursement rates negotiated by PPO plans with a wide range of providers help attract more doctors and hospitals to join their networks. This results in a larger pool of healthcare options for PPO plan members compared to non-PPO plans, where reimbursement rates are negotiated with a smaller, more tightly controlled network of providers.