Great Rates on California PPO Insurance Plans in 58 Counties

Are you shopping for insurance and considering a California PPO insurance plan? Or perhaps you just trying to gain a better understanding of the California PPO insurance market? At Vista Health, you will find key resources to help you decide on selecting the right California PPO plan.

Are you shopping for insurance and considering a California PPO insurance plan? Or perhaps you just trying to gain a better understanding of the California PPO insurance market? At Vista Health, you will find key resources to help you decide on selecting the right California PPO plan.

California PPO Health Insurance Rates for 2025

California PPO Health Insurance Rates for 2025

The figure below is a table of common individual California PPO plans from Cigna and Anthem Bluecross Blueshield Networks, including benefits and estimated premium rates. For more information, please do not hesitate to call us at 888-215-4045. (click the plan name to see more details).

CIGNA PPO PLANS

| Plan Name | Cigna PPO Low Plan | Cigna PPO Flex Plan | Cigna PPO High Plan | Cigna PPO Premium Plan |

|---|---|---|---|---|

| PCP Copay | $25 (6 visits limit) | $30 | $30 | $20 |

| Specialist Copay | $50 (6 visits limit) | $60 | $60 | $40 |

| Deductible | $0 | $6,000 | $3,000 | $1,000 |

| Rx: Generic/Brand/High Brand | $10 / NA / NA | $15 / $65 / $100 | $15 / $65 / $100 | $15 /$45 / $85 |

| Premium (single) | $510.00 | $854.50 | $958.00 | $1242.00 |

ANTHEM BLUE CROSS BLUE SHIELD PPO PLANS

Plan Name Anthem PPO Low Plan Anthem PPO Flex Plan Anthem PPO High Plan Anthem PPO Premium Plan

PCP Copay 0% after deductible $30 $30 $30

Specialist Copay 0% after deductible $60 $60 $60

Deductible $8,000 $6,000 $3,000 $1,000

Rx: Generic/Brand/High Brand 0% after deductible $15 / $65 / $100 $15 / $65 / $100 $15 / $65 / $100

Premium (single) $773.00 $839.00 $950.00 $1254.00

PPO Low Plan

Cigna PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 (6 visits limit) |

| Specialist Co-pay | $50 (6 visits limit) |

| Rx: Generic/Brand/High Brand | $10 / NA / NA |

| Emergency Room | $350 |

| Hospital Co-pay | $350 |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $0 |

| Max Out of Pocket (single/family) | $7,350 / $14,700 |

| In-Network Co-Insurance | N/A |

| Out-of-Network Benefits | ---------- |

| Deductible | N/A |

| Out of Pocket Max (single/family) | N/A |

| Co-Insurance | N/A |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $25 |

| Renewal Date | 20th of month Prior to Effective date |

| Premium | ---------- |

| Single | $510.00 |

| Couple | $817.00 |

| E+child | $736.25 |

| Family | $1,382.09 |

PPO Flex Plan

Cigna PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $6,000 / $12,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $12,000 / $24,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | --------------------- |

| Single | $854.50 |

| Couple | $1,492.00 |

| E+child | $1,345.50 |

| Family | $1,909.50 |

PPO High Plan

Cigna PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $3,000 / $6,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,000 / $12,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $958.00 |

| Couple | $1,684.00 |

| E+child | $1,516.00 |

| Family | $2,164.00 |

PPO Premium Plan

Cigna PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $15/$45/$85 |

| Emergency Room | 20% after deductible |

| Hospital Co-pay | 20% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $1,000 / $2,000 |

| Max Out of Pocket (single/family) | $5,000 / $10,000 |

| In-Network Co-Insurance | 20% |

| Out-of-Network Benefits | ---------- |

| Deductible | $2,000 / $4,000 |

| Out of Pocket Max (single/family) | $10,000 / $20,000 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $20 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $1242.00 |

| Couple | $2,257.00 |

| E+child | $2,018.00 |

| Family | $2,942.00 |

Anthem PPO Low Plan

Anthem PPO Low Plan

PPO Low Plan

In-Network Benefits ----------

Office Co-pay 0% after deductible

Specialist Co-pay 0% after deductible

Rx: Generic/Brand/High Brand 0% after deductible

Emergency Room 0% after deductible

Hospital Co-pay 0% after deductible

Referrals Needed No

In-Network Deductible (single/family) $8,000 / $16,000

Max Out of Pocket (single/family) $8,000 / $16,000

In-Network Co-Insurance N/A

Out-of-Network Benefits ----------

Deductible $16,000 / $32,000

Out of Pocket Max (single/family) $18,400 / $36,800

Co-Insurance 40%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance 0% after deductible

Renewal Date 01/01/2026

Premium ----------

Single $773.00

Couple $1,348.00

E+child $1,206.00

Family $1,754.00

PPO Flex Plan

Anthem PPO Flex Plan

PPO Flex Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $6,000 / $12,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ---------------------

Deductible $10,000 / $20,000

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ---------------------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ---------------------

Single $839.00

Couple $1,470.00

E+child $1,314.00

Family $1,915.00

PPO High Plan

Anthem PPO High Plan

PPO High Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $3,000 / $6,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ----------

Deductible $6,750 / $13,500

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ----------

Single $950.00

Couple $1,675.00

E+child $1,495.00

Family $2,186.00

PPO Premium Plan

Anthem PPO Premium Plan

PPO Premium Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $1,000 / $2,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ----------

Deductible $2,000 / $4,000

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ----------

Single $1254.00

Couple $2,238.00

E+child $1,995.00

Family $2,932.00

California PPO Insurance Carriers

We prepared a list of carriers that currently offer California PPO health insurance plans for Small Businesses in 2025. Due to market changes, only select carriers have made plans available to working individuals, Freelancers, and sole proprietors. Feel free to give us a call for the latest carrier information.

- Anthem Blue Cross Blue Shield

- Blue Cross Blue Shield of California

- Chinese Community Health Plan

- Health Net

- Kaiser Permanente

- L.A. Care Health Plan

- Molina HealthCare

- Oscar Health Plan

- Sharp Health Care

- Valley Health Plan

- Western Health Advantage

What You Should Know When Shopping for a California PPO Insurance Plan

Listed below are answers to the most common questions asked by those shopping for a California PPO insurance plan.

Are Your Doctors In-Network? – Most people don’t like change, especially when it comes to health insurance. The same can be said when it comes to Doctors, both primary care and specialists. With that said, you should always contact to ensure that your doctors are in-network, meaning that you are only subject to a copay (in most cases) to receive care. If your doctors are not in the PPO plan that you have selected then expect to pay a much higher price when receiving care from those doctors.

You need to contact the insurance company first to guarantee that your doctors are part of the network. You can also check the insurance carrier’s website and look for their provider listing. Then see if your doctors are listed. It is also possible that the listing has not been recently updated. You need to contact your doctor’s office as well to make sure they are in-network. Remember that with a CA PPO health plan, your out-of-network medical treatment will count towards your out-of-network deductible and that can be a large deductible to meet.

Lower Monthly Premium May Result in Higher Costs– The quality of health insurance is often inversely proportional to its price. A lower monthly premium means higher out-of-pocket expenses when you need medical services. This trade-off depends on your health status and how much care you anticipate to use in a year. If you have frequent or chronic health issues, you may benefit from paying more per month for a plan that covers more of your costs when you access care.

Your health is also a major factor when choosing a health plan. If you are in good health and don’t expect to receive much medical care for the duration of the plan year, you might want to opt for a less expensive health plan. Always consider your current health and health history when considering a CA PPO health insurance plan.

Health Insurance is a Contract – Health plans are usually purchased for a fixed time, such as a year. During this time, you cannot modify your plan unless you qualify for a special enrollment period. One of the reasons that can trigger a special enrollment period is losing your employer-sponsored health coverage. In that case, you may be eligible to enroll in a CA PPO health plan through the State marketplace, which offers more flexibility and choice of providers than other types of plans.

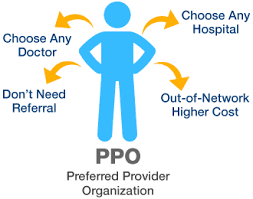

Insurance Coverage Type – PPO, EPO, POS, HMO, HDHP, and HSA are insurance plan designs with different levels of freedom regarding plan usage. For example, requiring no referrals to see a specialist is usually covered under an EPO and PPO plan. Furthermore, a CA PPO plan will enable you to receive quality care through an out-of-network specialist and out-of-network facilities.

If you need a flexible insurance plan that covers you in different states, you might consider a California PPO plan. This plan type lets you choose your doctors and hospitals. Another option is to enroll in an HDHP or HSA plan, which allows you to save money in a tax-free account for qualified medical expenses.

Are Essential Health Benefits Covered? – The 10 essential health benefits are a legal requirement for all PPO insurance plans in California. They ensure that the insured have access to a basic level of health care services. The Affordable Care Act established this standard to protect people from the high and rising costs of medical care, which can cause financial hardship for those with serious health problems. The minimum essential health benefits are a safety net for health insurance consumers.

Common Questions Relative to Purchasing a California PPO Health Insurance Plan

Common Questions Relative to Purchasing a California PPO Health Insurance Plan

Are California PPO Health Plans expensive?

California PPO insurance plans are more expensive than other plans they offer more choices and freedom for the employees. PPO plans allow people to see any provider they want, whether they are in-network or out-of-network, without needing a referral from a primary care physician. This means that PPO plans have larger networks of providers than other plans, which increases the cost of maintaining them. PPO plans also give people more flexibility to decide how much they want to pay for their care, depending on whether they choose an in-network or out-of-network provider. However, this also means that people may face higher deductibles, copayments, and coinsurance when they use out-of-network providers. You may use the table above to compare CA PPO plans side by side.

Does my doctor accept California PPO Insurance?

First, search for the health insurance companies above and choose your health insurance carrier. See if they have a dedicated PPO network section once you are in their provider directory. Look for your doctor in the listing and call the doctor’s office to ensure they are participating or not.

Where can I purchase a California PPO plan?

One way to buy a PPO health plan is to contact a broker who operates in your area and online. A broker can help you choose and use the policy that suits your needs. Look for a broker who works with different health insurance companies, so you have more options to compare.

How may I qualify for a CA PPO plan?

Being self-employed, a freelancer, or employed (at least part-time) will qualify you for a CA PPO Plan.

Can I purchase a CA PPO plan anytime?

Yes. You can purchase a CA PPO health plan anytime throughout the year. However, you must complete the application process before the 15th of the current month if you want your plan to start on the 1st day of the following month.

I am not happy with my CA PPO Health Plan. what should I do?

PPO Plans have a 1-year contract, as mentioned above. Making changes to your plan is not allowed. In rare cases, some companies do allow exceptions. However, most don’t. Selecting a new plan with a different carrier is your only option.

What makes a PPO plan special?

A PPO plan offers you the flexibility and freedom to choose any doctor or hospital you want, without worrying about network restrictions. You can access the highest quality of care and enjoy the benefits of your plan, as long as you are ready to pay your out-of-network deductible and coinsurance. This is a significant advantage over other plan types, such as an EPO or HMO plan, which limit you to their in-network providers.

Do I have to be in a certain employment status to buy a PPO plan?

The two most common ways of being covered under a CA PPO health plan are, as an employee of a company whose company plan is a PPO, or joining an association. The majority of associations are usually open to freelancers and sole proprietors.

Are CA State Exchange and healthcare.gov selling PPO health plans?

Only for small businesses. PPO and EPO plans are the closest plan types individuals can purchase. However, it doesn’t have the important out-of-network elements that PPO plans have.

Do freelancers qualify for CA PPO plans?

As a result of the affordable care act, a freelancer is now considered an individual, as such, they would need to join a business association that offers their membership California PPO insurance plan options.

Can Someone qualify for a PPO plan if they’re 65 or older?

The easy answer is yes. However, the situation is not very common. If you are 65 or older and work for an employer that offers a CA PPO plan, you can choose to stay on that plan instead of enrolling in Medicare. However, if you are not employed, you do not have this option because you cannot buy a PPO plan through an association when you are eligible for Medicare.

Are there short-term PPO medical plans?

Yes, there are some PPO Plan options available for someone who is in the market for a short-term medical plan. Unfortunately, many short-term medical plans have limited coverage and do not include the 10 Essential health benefits that are required by the Affordable Care Act. These benefits are important for your health and well-being and can protect you from high medical costs. Therefore, we recommend that you look for a comprehensive insurance plan that covers the 10 EHB and meets your needs and budget.

Why are PPO plans traditionally more expensive than non-PPO plans like HMOs?

PPO plans provide more benefits in terms of network size and coverage flexibility, as they allow their members to access care from out-of-network providers. This plan option comes with a higher premium and reflects the preferences of some providers who opt out of network contracts for various reasons. Often, these reasons include low reimbursement rates and strict protocols that discourage these providers from joining a network.

Doctors who are highly regarded in their specialty may choose not to contract with any insurance company. With reputation comes higher rates compared to other doctors in their specialty. You’re paying for that expertise. A CA PPO plan gives you the option to access those high-quality medical professionals, which results in higher premiums for the consumer.

Why do PPO plans have larger hospital and doctor networks compared to non-PPO plans?

Health insurance carriers in California offer PPO plans that pay their network doctors and hospitals higher rates than average. This is an incentive for them to join and stay in the network. On the other hand, doctors who are not satisfied with the lower rates of other plans, such as HMOs, may opt to participate in a PPO network instead.