Shop Florida PPO Health Insurance Plans in all 67 Counties

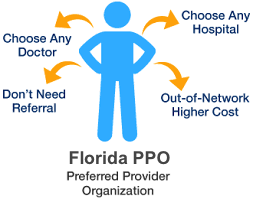

If you are interested in buying a Florida PPO health insurance plan, or if you just want to learn more about the Florida PPO health insurance market and compare prices, you have come to the right place. Here you will find all the essential resources to help you make an informed decision on choosing the best Florida PPO plan for your needs.

If you are interested in buying a Florida PPO health insurance plan, or if you just want to learn more about the Florida PPO health insurance market and compare prices, you have come to the right place. Here you will find all the essential resources to help you make an informed decision on choosing the best Florida PPO plan for your needs.

Florida PPO Rates for 2025

Florida PPO Rates for 2025

Here’s a table of Individual Florida PPO plans. The information below is approximate. Please call for detailed plan information. (click on the plan names to see more details)

| Plan Name | Cigna PPO Low Plan | Cigna PPO Flex Plan | Cigna PPO High Plan | Cigna PPO Premium Plan |

|---|---|---|---|---|

| PCP Copay | $25 (6 visits limit) | $30 | $30 | $20 |

| Specialist Copay | $50 (6 visits limit) | $60 | $60 | $40 |

| Deductible | $0 | $6,000 | $3,000 | $1,000 |

| Rx: Generic/Brand/High Brand | $10 / NA / NA | $15 / $65 / $100 | $15 / $65 / $100 | $15 /$45 / $85 |

| Premium (single) | $510.00 | $854.50 | $958.00 | $1242.00 |

PPO Low Plan

PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 (6 visits limit) |

| Specialist Co-pay | $50 (6 visits limit) |

| Rx: Generic/Brand/High Brand | $10 / NA / NA |

| Emergency Room | $350 |

| Hospital Co-pay | $350 |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $0 |

| Max Out of Pocket (single/family) | $7,350 / $14,700 |

| In-Network Co-Insurance | N/A |

| Out-of-Network Benefits | ---------- |

| Deductible | N/A |

| Out of Pocket Max (single/family) | N/A |

| Co-Insurance | N/A |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $25 |

| Renewal Date | 20th of month Prior to Effective date |

| Premium | ---------- |

| Single | $510.00 |

| Couple | $817.00 |

| E+child | $736.25 |

| Family | $1,382.09 |

PPO Flex Plan

PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $6,000 / $12,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $12,000 / $24,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | --------------------- |

| Single | $854.50 |

| Couple | $1,492.00 |

| E+child | $1,345.50 |

| Family | $1,909.50 |

PPO High Plan

PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $3,000 / $6,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,000 / $12,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $958.00 |

| Couple | $1,684.00 |

| E+child | $1,516.00 |

| Family | $2,164.00 |

PPO Premium Plan

PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $15/$45/$85 |

| Emergency Room | 20% after deductible |

| Hospital Co-pay | 20% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $1,000 / $2,000 |

| Max Out of Pocket (single/family) | $5,000 / $10,000 |

| In-Network Co-Insurance | 20% |

| Out-of-Network Benefits | ---------- |

| Deductible | $2,000 / $4,000 |

| Out of Pocket Max (single/family) | $10,000 / $20,000 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $20 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $1242.00 |

| Couple | $2,257.00 |

| E+child | $2,018.00 |

| Family | $2,942.00 |

Florida PPO Health Insurance Carriers

Listed below are Health insurance carriers that offer Florida PPO health insurance plans for sale in 2025 for the Small Business market. Only select carrier plans are available to work individuals, Freelancers, and the self-employed. Please call for the latest carrier information.

- Ambetter Health

- BlueCross BlueShield of Florida

- Bright Health

- Celtic Health

- Cigna

- EmblemHealth

- Health Insurance Plan of Greater Florida (HIP)

- HealthNow (BlueCross BlueShield)

- Molina Healthcare

- MVP Health Care (Mohawk Valley Physicians Health Plan)

- Oscar Health Insurance Plans

- Oxford Health Plans

- United Healthcare of Florida

What to Know When Shopping for a Florida PPO Insurance Plan

Below are the most common questions and concerns we hear when shopping for a Florida PPO health insurance plan.

Are Your Doctors In-Network? – Choosing a health insurance plan can be a daunting task, especially if you have a preferred general doctor. You need to ensure that your doctor still accepts new patients and that your plan covers their services. One option you may consider is an FL PPO plan, which allows you to see out-of-network providers. However, receiving care from an out-of-network doctor may cost substantially more than if that doctor is in-network.

Asking the receptionist of the doctor’s office if they accept a certain health insurance plan is just not enough. You should also contact the insurance carrier or your broker and confirm if your doctors are in-network. You also need to keep in mind that procedures requested or suggested by an out-of-network provider are all considered as out-of-network, even if the facilities and providers are in-network. With a Florida PPO health insurance plan, all of your out-of-network medical care will count toward your out-of-network deductible.

Lower Monthly Premium Might Mean Higher Costs – A lower monthly premium might mean higher overall costs as you use the plan along the way. If you are generally in good health and don’t use medicine on a very regular basis, then maybe you’re better off purchasing a low-cost health plan. On the same note, if you frequently use medical services and use medical prescriptions often, then you may save money in the long run by purchasing a high-premium health plan. Your health status is an important factor to keep in mind when choosing a Florida PPO health insurance plan.

Health Insurance is a Contract – Like every contract, it is binding for both parties for the duration of the agreed term (usually one year). You are responsible for choosing a suitable health plan and you cannot request a change from your insurance company mid-year if you are dissatisfied with your plan. As such, be sure to choose a plan that is a good match before signing a contract. If you had a State Marketplace plan or federal marketplace plan that has lapsed, you can get an FL PPO health plan mid-year as long as you are employed.

Types of Insurance Coverage – EPO, PPO, POS, HMO, HDHP, and HSA, are health insurance coverage types that provide you with different levels of flexibility in terms of seeking specialty care and receiving out-of-network and out-of-state care. Also, each coverage type has different requirements relative to the need for referrals. If you’re seeing specialists more often, an out-of-network plan offers you the flexibility needed.

Do you reside in multiple states per year, or travel often for work, then perhaps a Florida PPO plan’s flexibility is what you need. The last two types of plans, HDHP and HSA, allow you to create tax-free savings accounts specifically designed for qualified medical costs.

Are Essential Health Benefits Covered? – 10 essential health benefits are mandated to be covered by all ACA health plans. The importance of health insurance cannot be overstated, as it protects individuals from the high costs of medical services that could otherwise jeopardize their financial stability. A basic health plan that covers the essential health benefits is a prudent choice, as it ensures access to quality care and preventive services.

Most Common Questions Regarding a Florida PPO Health Plan

Most Common Questions Regarding a Florida PPO Health Plan

How much does a Florida PPO health insurance plan cost?

PPO plans typically have higher monthly premiums than other types of plans, because they offer more flexibility. The table above shows you the FL PPO rates and the available plans in your state.

Does my doctor accept Florida PPO Insurance?

To find out if your doctor is in the Florida PPO network, you can follow these steps:

— Look at the list of health insurance carriers on this website and click on your company name.

— Go to the PPO network section and search for your doctor by name or specialty.

— Alternatively, you can call your doctor’s office and ask them if they accept the Florida PPO plan that you have or are interested in.

Where can I buy a Florida PPO health insurance plan?

You can access a network of qualified brokers who can help you find the best plan for your needs and budget. They will also provide ongoing support and assistance with any premium or claims issues that may arise during the plan year. To get started, contact a broker who is appointed with every carrier in the state and explore the wide range of plans available to you.

Am I qualified for an FL PPO plan?

In most cases to qualify for an FL PPO plan, the person applying must either be employed, self-employed or a freelancer.

Can I buy an FL PPO plan anytime?

Yes. FL PPO health plans have a first-of-the-month start date throughout the year. You should complete your application by the 15th of the prior month for coverage to begin on the 1st of the month.

I don’t like my current FL PPO health plan, can I switch plans?

According to the terms and conditions of your PPO plan, you are not eligible to change your plan until the next renewal date, which is usually one year after the start date of your coverage. However, you have the option to switch to a different FL PPO plan from another insurance company at any time during the year, subject to their availability and approval.

What makes a PPO plan special?

It’s always the flexibility of a PPO health plan that makes it special You can go to any doctor of your choice. That’s a tremendous advantage as compared to other plan types such as an EPO or HMO plan, where you must use their in-network providers. This is most true for those who are frequent travelers and want to be able to see a doctor or specialist anywhere throughout the country.

Do I have to be self-employed or part of a group to buy a PPO plan?

The two most common ways of getting an FL PPO health plan are, as an employee of a company whose company plan is a PPO. The second most common way is for individuals, freelancers, and the self-employed to become part of a business association that offers PPO plans.

Can I get PPO health plans from State Exchange and healthcare.gov?

Not for Individual health coverage, Only EPO and HMO plans are offered on the Federal Exchange and State Exchanges. For small businesses, yes though they tend to be limited.

Do freelancers qualify for FL PPO plans?

By law, freelancers are considered individuals, which means they would need to join an association that is offering a Florida PPO health plan to be eligible to purchase insurance.

I am turning 65 soon. Am I still qualified for a PPO plan?

If you work for a company and are 65 you often have the option of keeping your FL PPO health insurance plan, instead of going on Medicare. If a senior is not employed, they would not be eligible for a Florida PPO health insurance plan.

Are PPO plans offered as short-term medical plans?

Yes. there are PPO plans that are available as short term however many of those medical plans are not comprehensive health insurance so it, let the buyer beware and be sure to review the summary of benefits.

Why are PPO plans usually more expensive than other health plans like HMOs?

PPO plans are more expensive than other types of health plans like HMOs because they offer more flexibility and choice to the members. PPO plans allow members to see any provider they want, without needing a referral from a primary care physician. They also cover a higher percentage of the costs for out-of-network providers than HMO plans. These features make PPO plans more attractive to people who value convenience and autonomy, but they also come with higher premiums, deductibles, and copayments.

Why are there more doctors and hospitals in a PPO plan network than in non-PPO plans?

PPO plans offer higher reimbursement levels to doctors and hospitals as an incentive for their participation. This means that some doctors who are not willing to accept the lower reimbursement levels of other insurance plans, such as HMOs, will choose to join a PPO. This gives PPO members more flexibility and choice in their healthcare providers.