Shop Georgia PPO Health Insurance Plans in all 159 Counties

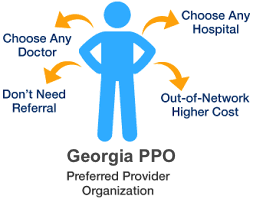

Are you in search of a Georgia PPO plan? Do you want to gain insights into the Georgia PPO health insurance market and compare rates effectively? At Vista Health Solutions, we specialize in PPOs and various plan options. We’ll provide you with all the necessary information to assist you in shopping for and comparing Georgia PPO plans.

Are you in search of a Georgia PPO plan? Do you want to gain insights into the Georgia PPO health insurance market and compare rates effectively? At Vista Health Solutions, we specialize in PPOs and various plan options. We’ll provide you with all the necessary information to assist you in shopping for and comparing Georgia PPO plans.

Georgia PPO Rates for 2025

Below is a table containing various individual Georgia PPO plans from Cigna and Anthem Bluecross Blueshield Networks, along with their respective rates and benefits. Please note that this information is approximate, and it is recommended that you call for specific details about each plan. (click the plan name to see more details).

CIGNA PPO PLANS

| Plan Name | Cigna PPO Low Plan | Cigna PPO Flex Plan | Cigna PPO High Plan | Cigna PPO Premium Plan |

|---|---|---|---|---|

| PCP Copay | $25 (6 visits limit) | $30 | $30 | $20 |

| Specialist Copay | $50 (6 visits limit) | $60 | $60 | $40 |

| Deductible | $0 | $6,000 | $3,000 | $1,000 |

| Rx: Generic/Brand/High Brand | $10 / NA / NA | $15 / $65 / $100 | $15 / $65 / $100 | $15 /$45 / $85 |

| Premium (single) | $510.00 | $854.50 | $958.00 | $1242.00 |

ANTHEM BLUE CROSS BLUE SHIELD PPO PLANS

Plan Name Anthem PPO Low Plan Anthem PPO Flex Plan Anthem PPO High Plan Anthem PPO Premium Plan

PCP Copay 0% after deductible $30 $30 $30

Specialist Copay 0% after deductible $60 $60 $60

Deductible $8,000 $6,000 $3,000 $1,000

Rx: Generic/Brand/High Brand 0% after deductible $15 / $65 / $100 $15 / $65 / $100 $15 / $65 / $100

Premium (single) $773.00 $839.00 $950.00 $1254.00

PPO Low Plan

Cigna PPO Low Plan

| PPO Low Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $25 (6 visits limit) |

| Specialist Co-pay | $50 (6 visits limit) |

| Rx: Generic/Brand/High Brand | $10 / NA / NA |

| Emergency Room | $350 |

| Hospital Co-pay | $350 |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $0 |

| Max Out of Pocket (single/family) | $7,350 / $14,700 |

| In-Network Co-Insurance | N/A |

| Out-of-Network Benefits | ---------- |

| Deductible | N/A |

| Out of Pocket Max (single/family) | N/A |

| Co-Insurance | N/A |

| Other Benefits | ---------- |

| Vision/Dental | N/A |

| Mental/Substance | $25 |

| Renewal Date | 20th of month Prior to Effective date |

| Premium | ---------- |

| Single | $510.00 |

| Couple | $817.00 |

| E+child | $736.25 |

| Family | $1,382.09 |

PPO Flex Plan

Cigna PPO Flex Plan

| PPO Flex Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $6,000 / $12,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | --------------------- |

| Deductible | $12,000 / $24,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | --------------------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | --------------------- |

| Single | $854.50 |

| Couple | $1,492.00 |

| E+child | $1,345.50 |

| Family | $1,909.50 |

PPO High Plan

Cigna PPO High Plan

| PPO High Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $30 |

| Specialist Co-pay | $60 |

| Rx: Generic/Brand/High Brand | $15/$65/$100 |

| Emergency Room | 30% |

| Hospital Co-pay | 30% |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $3,000 / $6,000 |

| Max Out of Pocket (single/family) | $9,450 / $18,900 |

| In-Network Co-Insurance | 30% |

| Out-of-Network Benefits | ---------- |

| Deductible | $6,000 / $12,000 |

| Out of Pocket Max (single/family) | $18,900 / $37,900 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $30 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $958.00 |

| Couple | $1,684.00 |

| E+child | $1,516.00 |

| Family | $2,164.00 |

PPO Premium Plan

Cigna PPO Premium Plan

| PPO Premium Plan | |

|---|---|

| In-Network Benefits | ---------- |

| Office Co-pay | $20 |

| Specialist Co-pay | $40 |

| Rx: Generic/Brand/High Brand | $15/$45/$85 |

| Emergency Room | 20% after deductible |

| Hospital Co-pay | 20% after deductible |

| Referrals Needed | No |

| In-Network Deductible (single/family) | $1,000 / $2,000 |

| Max Out of Pocket (single/family) | $5,000 / $10,000 |

| In-Network Co-Insurance | 20% |

| Out-of-Network Benefits | ---------- |

| Deductible | $2,000 / $4,000 |

| Out of Pocket Max (single/family) | $10,000 / $20,000 |

| Co-Insurance | 40% |

| Other Benefits | ---------- |

| Vision/Dental | Pediatric Vision |

| Mental/Substance | $20 |

| Renewal Date | 01/01/2026 |

| Premium | ---------- |

| Single | $1242.00 |

| Couple | $2,257.00 |

| E+child | $2,018.00 |

| Family | $2,942.00 |

Anthem PPO Low Plan

Anthem PPO Low Plan

PPO Low Plan

In-Network Benefits ----------

Office Co-pay 0% after deductible

Specialist Co-pay 0% after deductible

Rx: Generic/Brand/High Brand 0% after deductible

Emergency Room 0% after deductible

Hospital Co-pay 0% after deductible

Referrals Needed No

In-Network Deductible (single/family) $8,000 / $16,000

Max Out of Pocket (single/family) $8,000 / $16,000

In-Network Co-Insurance N/A

Out-of-Network Benefits ----------

Deductible $16,000 / $32,000

Out of Pocket Max (single/family) $18,400 / $36,800

Co-Insurance 40%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance 0% after deductible

Renewal Date 01/01/2026

Premium ----------

Single $773.00

Couple $1,348.00

E+child $1,206.00

Family $1,754.00

PPO Flex Plan

Anthem PPO Flex Plan

PPO Flex Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $6,000 / $12,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ---------------------

Deductible $10,000 / $20,000

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ---------------------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ---------------------

Single $839.00

Couple $1,470.00

E+child $1,314.00

Family $1,915.00

PPO High Plan

Anthem PPO High Plan

PPO High Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $3,000 / $6,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ----------

Deductible $6,750 / $13,500

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ----------

Single $950.00

Couple $1,675.00

E+child $1,495.00

Family $2,186.00

PPO Premium Plan

Anthem PPO Premium Plan

PPO Premium Plan

In-Network Benefits ----------

Office Co-pay $30

Specialist Co-pay $60

Rx: Generic/Brand/High Brand $15/$65/$100

Emergency Room 30%

Hospital Co-pay 30% after deductible

Referrals Needed No

In-Network Deductible (single/family) $1,000 / $2,000

Max Out of Pocket (single/family) $9,200 / $18,400

In-Network Co-Insurance 30%

Out-of-Network Benefits ----------

Deductible $2,000 / $4,000

Out of Pocket Max (single/family) $18,400/ $36,800

Co-Insurance 30%

Other Benefits ----------

Vision/Dental Pediatric Vision and Dental

Mental/Substance $30

Renewal Date 01/01/2026

Premium ----------

Single $1254.00

Couple $2,238.00

E+child $1,995.00

Family $2,932.00

Georgia PPO Insurance Carriers

Here is the list of carriers offering Georgia PPO health insurance plans for Small Businesses in 2025. Please note that due to marketplace changes, only specific carriers are providing plans for individuals who are working, Freelancers, and the self-employed. For the most up-to-date information on health carriers, feel free to give us a call.

- Aetna

- Ambetter

- Anthem Blue Cross Blue Shield

- Cigna

- Kaiser Permanente

- Humana

- Oscar Health Insurance Plan

- United HealthCare

What to Know When Shopping for a Georgia PPO Insurance Plan

Below are some frequently asked questions we encounter regarding shopping for a Georgia PPO health plan.

Are Your Doctors In-Network – Before purchasing a health insurance plan, it’s crucial to ensure that your most frequently visited doctors are part of the network, even though a PPO plan covers out-of-network costs. Using an out-of-network provider can result in significantly higher costs compared to in-network doctors.

Rather than relying solely on the doctor’s office, confirm with the insurance carrier, agent, or broker that your doctors are indeed in-network. This is important because if an out-of-network physician recommends services, all those services will be considered out-of-network, even if the facilities and other doctors are in-network. On a positive note, with a GA PPO health plan, any out-of-network medical expenses will count toward your out-of-network deductible.

Lower Monthly Premium May Result in Higher Costs– Choosing a lower monthly premium for health insurance may lead to higher overall costs. If you’re in good health, rarely require medical care or medications, a lower-cost plan may be suitable. However, if you have high medical expenses and regular drug usage, a plan with a higher monthly premium might be more cost-effective. Always consider your current health status when selecting a Georgia PPO health insurance plan.

Health Insurance is a Contract – Health insurance operates as a contract, where both the insurer and insured commit to its terms, typically for a year. If you discover that you’re dissatisfied with your plan during the year, you cannot make changes to the coverage mid-year. Therefore, it’s crucial to carefully select the right plan that suits your needs before signing the contract. However, If your most recent State Marketplace plan was canceled or lapsed, you can purchase a GA PPO health plan mid-year, as long as you are employed. This option is available to individuals who experienced the cancellation or lapse of their previous plan and are currently employed.

Types of Insurance Coverage – EPO, PPO, POS, HMO, HDHP, and HSA are different acronyms that describe certain types of health insurance coverages that have or don’t have the freedom to receive out-of-network and out-of-state coverage. Also, different plans have different needs related to referrals. If you’re regularly seeing out-of-network providers, then you should opt for a plan that has that flexibility.

If you are on the road for work or live in several states throughout the year, then a GA Plan is your best choice. HDHP and HSA’s have a tax-free savings account element specifically for qualified medical costs, that you can opt for through special HSA banks.

Are Essential Health Benefits Covered? – All Georgia PPO plans cover the 10 essential health benefits. This provides the insured with a minimum level of coverage that is guaranteed. That minimum level is the standard set by the Affordable Care Act. Why did the ACA consider minimum standard levels of coverage? Well, the cost of medical care is excessively high and without an insurance plan in place, it can often lead to financial ruin. By building in a guaranteed element, provides us with a safeguard.

Most Common Questions Regarding a Georgia PPO Health Plan

Most Common Questions Regarding a Georgia PPO Health Plan

How much does a Georgia PPO cost?

The cost of a Georgia PPO health plan is typically higher than other plans because of the increased freedom they offer. You can refer to the table above to view GA PPO rates and explore different plans available in your state.

Does my doctor accept Georgia PPO Insurance?

To determine if your doctor accepts Georgia PPO Insurance, you can follow these steps:

- Identify your health insurance company from the list provided above.

- Visit their website and navigate to their network listing.

- Look for the PPO network section to check if your doctor is listed as an in-network provider.

- While you can call your physician’s office for confirmation, it is recommended to reach out to the health insurance company to ensure accuracy.

Where can I buy a Georgia PPO health insurance plan?

Georgia PPO health insurance plans can be purchased through broker representatives. These brokers not only help set up the health plan but also provide assistance with any premium or claims-related issues throughout the plan year. It is advisable to collaborate with an established broker who works with every carrier in the region, as it offers a broader selection of companies and plans, giving you more options to choose from.

Do I qualify for a GA PPO plan?

To be eligible for a GA PPO plan, applicants must fall into one of the following categories: employed, self-employed, or a freelancer. These individuals have the opportunity to apply and enroll in a GA PPO health insurance plan.

Can I buy a GA PPO plan anytime?

Indeed, GA PPO health insurance plans can start at the beginning of any month throughout the year. To ensure your plan’s effective date is on the 1st of the following month, you typically need to submit your application by the 15th of the prior month. This timeline allows for a smooth transition and timely coverage.

What happens if I’m not happy with my GA PPO health plan, can I change it?

As the PPO health plan is a contractual agreement, making changes to your plan before its renewal date, one year after the start, is not possible. However, you can switch plans mid-year by opting for a different insurance carrier.

What makes a PPO plan special?

The flexibility PPOs have is what makes them unique. You can visit any doctor you choose. That’s a strong benefit as compared to an EPO or HMO that requires you to use their in-network providers. This is especially important for those who travel often and need to be able to see a doctor or specialist throughout the country.

Are you required to be self-employed or part of a group to buy into a PPO plan?

To enroll in a GA PPO health plan, you have two primary options. The first is to become an employee of a company that offers a PPO insurance plan. The second option is available to working individuals, freelancers, and sole proprietors who can join a business association that provides a PPO plan.

Can I buy a PPO Plan on the State Exchange or healthcare.gov?

For Individual health plans, no it is not an option. Your options through the Federal Exchange and State Exchanges are EPO and HMO. Small employers do have the option to purchase PPO plans, however, they are limited.

Do freelancers qualify for GA PPO plans?

Since the drafting of the ACA, a freelancer has the same limited opportunities as an individual, and therefore they would need to become a member of an association that is offering a PPO health plan option.

Are seniors aged 65 and older eligible for PPOs?

If the senior is employed and the company offers a PPO plan, they would likely choose to keep the health plan rather than enroll in Medicare. However, if the senior is not employed with the company, they would not be eligible for a Georgia PPO plan.

Can a PPO plan be a short-term medical plan?

Yes. If you’re looking for a short-term medical plan you can find some that have PPO networks, however, almost all short-term medical plans are not true health insurance policies so be sure to choose wisely.

How come PPO plans cost more than other types of health plans like HMOs and EPOs?

Georgia PPO plans are intentionally designed to be flexible, providing a higher reimbursement rate to selected medical practitioners and hospitals. However, they often come with a higher cost compared to other plan types like HMO or EPO, which require members to stay within the network. The ability to access any provider nationwide comes with a premium price tag.

Why is it that PPO plans have more hospitals and doctors in their networks than non-PPO plans?

PPO Health Insurance companies offer higher-than-average reimbursement rates to their selected doctors and hospitals who participate in their PPO health insurance plans. On the other hand, HMOs and EPO plan types do not provide the same level of reimbursement, leading many highly skilled physicians to opt out of these lower-reimbursed plans.