California PPO Health Insurance Plans 2025

Maximum flexibility and choice with the largest provider networks in California. No referrals needed, out-of-network coverage available. Licensed PPO specialists serving all 58 counties.

Looking for maximum flexibility and choice in your health insurance? California PPO insurance plans offer unmatched freedom to see any doctor, visit any specialist, and access any hospital without referrals or network restrictions. As California’s leading PPO specialists, we help you navigate the complex landscape of Preferred Provider Organization plans to find coverage that matches your lifestyle and healthcare needs.

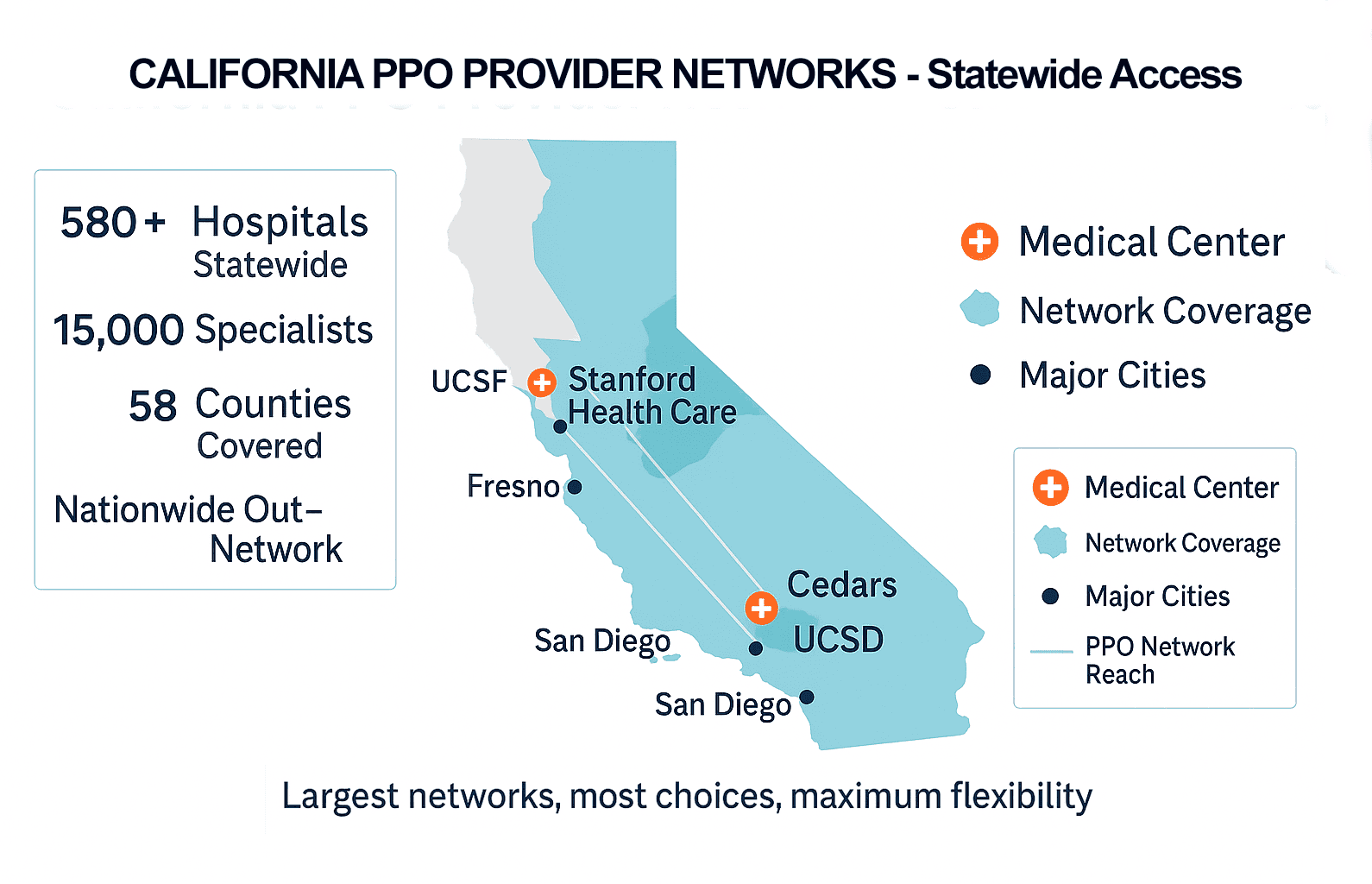

California’s diverse geography and world-class healthcare system make PPO plans particularly valuable. Whether you’re in Los Angeles accessing Cedars-Sinai, seeking care at UCSF Medical Center in San Francisco, or visiting specialists throughout the state, PPO coverage ensures you can receive care where and when you need it most. Our comprehensive approach helps you understand not just plan costs, but total healthcare value across California’s 58 counties.

Why California Residents Choose PPO Plans

California’s mobile lifestyle, diverse healthcare needs, and premium medical institutions make PPO plans the preferred choice for those who want maximum control over their healthcare decisions. From Silicon Valley executives to Central Valley families, PPO flexibility adapts to your unique situation.

Benefits of California PPO Health Insurance Plans

PPO health plans in California provide unparalleled flexibility and comprehensive coverage options that adapt to your lifestyle and healthcare preferences. Understanding these advantages helps you make informed decisions about your health insurance investment.

🏥 No Referrals Required

Direct specialist access – See cardiologists, orthopedists, dermatologists, and other specialists immediately without primary care physician referrals.

- Immediate access to specialists

- No waiting for referral approvals

- Direct scheduling with top doctors

- Emergency specialist care covered

- Second opinions easily obtained

🏥 Largest Provider Networks

Access California’s most extensive networks including major health systems, independent practices, and renowned medical centers throughout the state.

- UCSF Health System access

- Cedars-Sinai Medical Center

- UCLA Health network

- Stanford Health Care

- Independent specialist practices

🏥 Out-of-Network Coverage

Unique PPO advantage – Receive care from any provider in California or nationwide, even if they’re not in your plan’s network.

- Nationwide coverage when traveling

- Access to exclusive specialists

- Emergency care anywhere

- Higher costs but still covered

- No network restrictions

California PPO Insurance Costs and Plan Options

PPO insurance costs in California vary significantly based on coverage level, deductible amount, provider network size, and individual factors such as age and location. Understanding these cost structures helps you select the plan that provides the best value for your specific needs.

| Plan Level | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum | Best For |

|---|---|---|---|---|

| Bronze PPO | $350–$450 | $6,000–$8,000 | $8,500–$9,500 | Healthy individuals, emergency coverage |

| Silver PPO | $500–$650 | $3,500–$5,000 | $8,500–$9,200 | Moderate healthcare usage |

| Gold PPO | $700–$900 | $1,500–$3,000 | $8,500–$9,200 | Regular medical care, prescriptions |

| Platinum PPO | $900–$1,200 | $500–$1,500 | $5,000–$8,500 | Frequent healthcare needs, chronic conditions |

- San Francisco Bay Area: $450-$1,300 monthly (highest costs, most options)

- Los Angeles County: $380-$1,100 monthly (competitive market)

- San Diego County: $400-$1,150 monthly (balanced costs and networks)

- Central Valley: $350-$950 monthly (most affordable region)

- Rural Counties: $375-$1,000 monthly (limited but essential coverage)

Major PPO Providers in California

California’s robust PPO market includes national carriers and regional specialists, each offering different network strengths, coverage options, and pricing strategies. Understanding provider differences helps you choose the PPO plan that best matches your healthcare preferences.

Leading California PPO Insurance Companies

🏥 Anthem Blue Cross PPO

Largest statewide network with comprehensive coverage across all 58 California counties and strong specialist access.

- Extensive statewide network

- Strong specialist coverage

- Competitive premium rates

- Excellent rural area coverage

🏥 Blue Shield of California PPO

Comprehensive PPO options with strong Northern California presence and innovative care coordination programs.

- Strong Northern CA networks

- Innovative care programs

- Flexible plan designs

- Quality provider relationships

🏥 Health Net PPO

Value-focused PPO plans with competitive pricing and solid network coverage throughout California’s major metropolitan areas.

- Competitive pricing structure

- Metro area focus

- Value-oriented plans

- Good specialist access

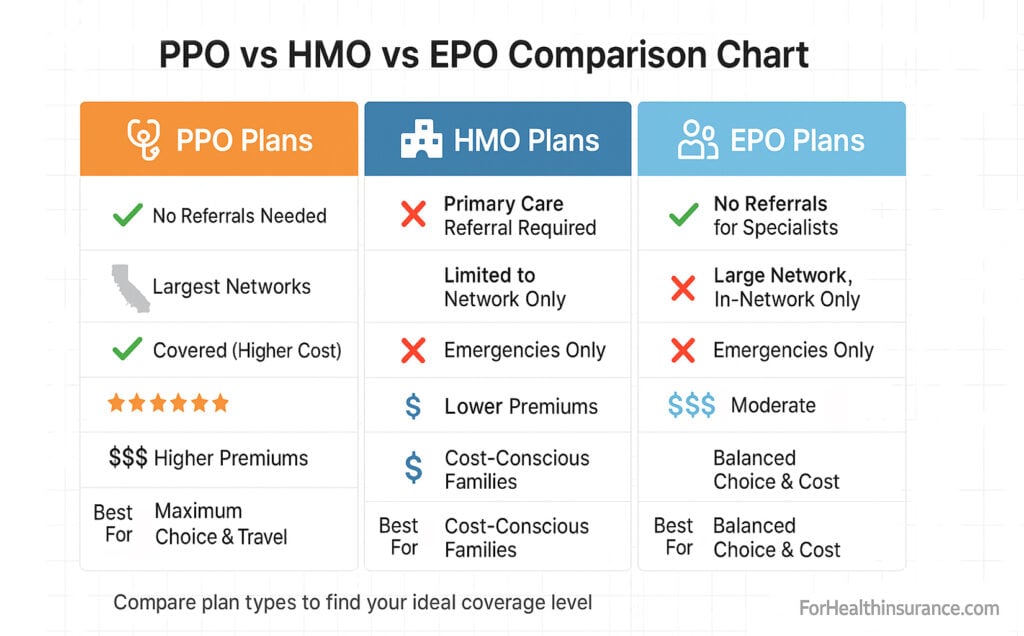

PPO Plans vs Other California Health Insurance Options

Understanding how PPO plans compare to HMO, EPO, and other plan types helps you make informed decisions about coverage trade-offs, costs, and healthcare access in California’s diverse market.

PPO vs HMO: Key Differences

| Feature | PPO Plans | HMO Plans |

|---|---|---|

| Referrals Required | No – Direct specialist access | Yes – Primary care referral needed |

| Out-of-Network Coverage | Yes – Higher cost but covered | No – Emergencies only |

| Provider Choice | Any doctor or hospital | Network providers only |

| Monthly Premiums | Higher – More flexibility | Lower – Limited flexibility |

| Geographic Coverage | Nationwide coverage | Regional network only |

When PPO Plans Make Sense

PPO health plans in California are particularly valuable for:

- Frequent travelers: Business professionals who need nationwide coverage

- Specialist care needs: Individuals with chronic conditions requiring specialist management

- Provider loyalty: People with established relationships with specific doctors

- Second opinions: Those who want easy access to multiple medical opinions

- Premium care access: Individuals seeking California’s top medical institutions

- Rural residents: People in areas with limited HMO network coverage

California-Specific PPO Advantages

California’s geography, from major metropolitan areas to rural regions, makes PPO flexibility particularly valuable. Whether you’re accessing world-class care in San Francisco, specialized treatment in Los Angeles, or emergency services while traveling throughout the state, PPO coverage adapts to California’s diverse healthcare landscape.

Choosing the Right California PPO Plan

Selecting the optimal PPO insurance plan requires careful evaluation of your healthcare needs, budget constraints, provider preferences, and lifestyle factors. Our systematic approach helps you identify the PPO plan that provides the best value for your specific situation.

Step 1: Assess Your Healthcare Needs

Honest evaluation of your medical requirements helps determine appropriate coverage levels:

- Current health status: Chronic conditions, medications, ongoing treatments

- Specialist requirements: Cardiology, orthopedics, dermatology, mental health

- Prescription medications: Brand name drugs, specialty medications

- Planned procedures: Surgery, diagnostic testing, preventive care

- Family considerations: Maternity care, pediatric needs, elderly parent care

Step 2: Evaluate Provider Networks

California’s diverse healthcare landscape requires careful network analysis:

🏥 Northern California Networks

- UCSF Health System

- Stanford Health Care

- Sutter Health

- Kaiser Permanente (limited PPO)

🏥 Southern California Networks

- Cedars-Sinai Medical Center

- UCLA Health

- USC Keck Medicine

- City of Hope

Step 3: Calculate Total Healthcare Costs

Look beyond monthly premiums to understand total annual healthcare expenses:

Step 4: Consider Lifestyle Factors

- Travel frequency: Business or personal travel requiring nationwide coverage

- Work schedule: Flexibility needs for appointment scheduling

- Family dynamics: Children’s activities, elderly parent care coordination

- Risk tolerance: Comfort level with higher deductibles vs. premiums

Working with California PPO Insurance Specialists

Navigating California’s complex PPO market requires expertise in carrier differences, network variations, and cost optimization strategies. Our licensed PPO specialists provide personalized guidance to help you make informed decisions about your health insurance investment.

Why Choose ForHealthInsurance.com for PPO Plans?

🏥 PPO Expertise

Specialized knowledge of California PPO markets, provider networks, and plan differences across all major carriers.

🏥 Statewide Coverage

Licensed agents serving all 58 California counties with local market knowledge and carrier relationships.

🏥 No-Cost Consultation

Complete PPO analysis, plan comparisons, and enrollment assistance at no charge to you.

Our PPO Selection Process

- Needs Assessment: Comprehensive evaluation of healthcare requirements

- Network Analysis: Provider verification and hospital access confirmation

- Cost Modeling: Total expense calculations including premiums and out-of-pocket costs

- Plan Comparison: Side-by-side analysis of coverage options and benefits

- Enrollment Support: Application assistance and ongoing service

California PPO Market Insights

Our deep California market knowledge includes understanding regional network strengths, carrier performance differences, and emerging trends in PPO coverage. We help you navigate complexities like network adequacy in rural areas, specialist availability, and cost variations across the state’s diverse regions.

California PPO Insurance Resources

Learn the essentials of California health insurance, including coverage options, enrollment guidance, and statewide plan availability.

Find out how premium assistance programs and tax credits reduce health insurance costs for eligible California residents.

Get insight into premiums, deductibles, and out-of-pocket costs that affect California health plan affordability.

Review top California health insurance plans by network, benefits, and pricing to find the best coverage for your needs.

Explore healthcare plan structures, benefit tiers, and managed care options offered through California’s top insurers.

Access affordable California health insurance options with reliable coverage and eligibility for state or federal support.

Frequently Asked Questions About California PPO Insurance

What makes PPO plans different from other health insurance options in California?

PPO plans offer maximum flexibility with no referrals required for specialists, out-of-network coverage options, and the largest provider networks in California. Unlike HMO plans, you can see any doctor or specialist immediately, and unlike EPO plans, you have out-of-network benefits for emergency situations or when seeing preferred providers outside the network.

How much more do PPO plans cost compared to HMO plans in California?

PPO plans typically cost 20-40% more than comparable HMO plans due to increased flexibility and larger networks. However, the additional cost often provides significant value through direct specialist access, out-of-network coverage, and freedom to choose any provider without referral restrictions.

Can I use my California PPO plan when traveling outside the state?

Yes, PPO plans provide nationwide coverage, making them ideal for frequent travelers. You can receive care from any provider in the United States, though out-of-network providers may result in higher out-of-pocket costs. Emergency care is always covered at in-network rates regardless of location.

Which California hospitals and medical centers accept PPO insurance?

Most major California medical institutions participate in PPO networks, including UCSF Medical Center, Cedars-Sinai, UCLA Health, Stanford Health Care, and hundreds of community hospitals statewide. PPO plans typically offer the broadest hospital access of any plan type.

Do I need to choose a primary care physician with a PPO plan?

No, PPO plans do not require you to select a primary care physician or obtain referrals for specialist care. You have complete freedom to see any provider, schedule appointments directly with specialists, and coordinate your own care as needed.

How do I find out if my current doctors accept a specific PPO plan?

Contact the insurance carrier directly or use their online provider directory to verify participation. Always confirm with both the insurance company and your doctor’s office before enrolling, as network participation can change. Our brokers also provide comprehensive provider verification services during the selection process.

Ready to Find Your Perfect California PPO Plan?

Our licensed PPO specialists are ready to help you compare California PPO insurance options and find coverage that provides maximum flexibility and value. Get personalized recommendations from experts who understand PPO plans.

Call PPO Specialists: 1-888-215-4045Licensed brokers specializing in California PPO health insurance plans

Get Free PPO Quotes OnlineYour Next Steps to California PPO Coverage

Choosing the right PPO health insurance plan in California is an investment in your healthcare freedom and peace of mind. With California’s exceptional medical institutions, diverse specialist networks, and innovative healthcare technologies, having PPO flexibility ensures you can access the best care available when and where you need it most.

Whether you’re a business professional requiring nationwide coverage, a family seeking comprehensive specialist access, or an individual who values choice in healthcare decisions, California PPO plans provide the flexibility to match your lifestyle and medical needs. Our experienced PPO specialists understand the nuances of California’s insurance market and help you navigate carrier differences, network variations, and cost optimization strategies.

Contact ForHealthInsurance.com today to speak with licensed California PPO insurance specialists. We’re committed to helping you find comprehensive PPO coverage that provides access to California’s world-class healthcare system while respecting your budget and coverage preferences. Let our PPO expertise and carrier relationships work for you in securing the flexible health insurance protection you deserve.